(833) 379-1951 TTY 711

Medicare Advantage (Part C)

What are Medicare Advantage (Part C) plans?

Medicare Advantage (also called Medicare Part C or "MA" plans) are alternative plans to Medicare Part A and B that are provided by private, Medicare-approved companies. Importantly, MA plans may also include Part D prescription drug coverage.

MA plans are available as HMO or PPOs:

HMO (Health Maintenance Organization) - These plans typically require referrals from your primary care physician to see a specialist. Importantly, these plans do not provide out-of-network coverage except for emergency or urgent care. In other words, if you are traveling and seek non-emergency care from an out-of-network hospital or provider, your HMO plan will not cover these expenses.

PPO (Preferred Provider Organization) - These plans allow you to see specialists without a referral from your primary care physician. Unlike HMO plans, with a PPO you can see out-of-network providers for non-emergency care, although there is typically a higher cost than when you see your in-network provider.

Why Choose a Medicare Advantage Plan?

MA plans cover a wide range of services including:

Inpatient hospital care

Skilled Nursing Facility (SNF) care

Hospice

Home Health care

Outpatient doctor visits

Preventive screenings (e.g. Cardiovascular and cancer screenings)

Diabetes screenings and supplies

Wellness visits (e.g. flu and vaccinations)

Certain ambulance services and transportation

Maximum out-of-pocket limits

Additionally, many MA plans offer a wide range of extra benefits not provided by Original Medicare including:

Dental

Vision

Hearing

Fitness (e.g. gym memberships)

Transportation to doctor's appointments

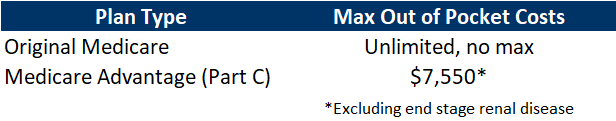

Maximum Out of Pocket Limit

Original Medicare (Part A and B), does not have a limit on your maximum out of pocket costs.

A Medicare Advantage plan caps your out of pocket costs at $7,550 per year (excluding those with end stage renal disease). Because Original Medicare does not include a maximum out-of-pocket limit, you could pay more than $10,000 or more for services.

What is covered?

Inpatient Hospital Coverage

MA plans cover your inpatient hospital coverage including:

"Room and Board"

Semi-Private room and bed

Nursing care

Medication

Lab services

Medical supplies

Three meals per day

Skilled Nursing Facility Care

Skilled Nursing Facility (SNF) care includes:

Physical therapy

Occupational therapy

Speech-language pathology services

Medical social services

Medication

Certain Ambulance transportation

Dietary/nutrition counseling

Home Health Care

MA plans cover a wide range of services from the comfort of your own home including:

Wound care for pressure sores or a surgical wounds

Patient and caregiver education

Intravenous or nutrition therapy

Injections

Monitoring serious illness and unstable health status

Outpatient Office Visits

Outpatient physician visits are also covered as part of your MA plan

Outpatient physician office visits

Preventive screenings

Primary Care

Specialists

Preventive Care & Wellness

MA plans cover a variety of preventive care services and wellness initiatives:

Diabetes screening and supplies

Medical and cancer screenings

Annual wellness visits

Flu shots and vaccinations

Mobility Equipment

Durable medical equipment is covered if you have a disability that prevents you from bathing, toileting, personal care, feeding or dressing

Canes

Walkers

Scooters

Wheelchairs

Oxygen tanks

How do I enroll?

To enroll in a Medicare Advantage (Part C) plan:

Enroll in Medicare Part A and B

If you are new to Medicare, you must pay Part B monthly premiums (the standard premium in 2022 is $170.10 per month).

You may have Medical Part C premiums that may include prescription drug coverage

To find a Medicare Advantage plan that meets your needs, please contact us for a free consultation with a licensed agent at

(833) 379-1951.

We offer plans with leading carriers

Interested in a Medicare Advantage plan?

Speak with a licensed agent and get your free quote today!

(833) 379-1951

Fax (727) 472-0337

support@seniorhealthinsurancedirect.com

By submitting your information to us, you expressly consent to receive emails and phone calls via automatic telephone dialing system or by artificial/re-recorded message, or by text message from licensed sales agents of Senior Health Insurance Direct LLC, its affiliates, partner companies, and their partners at the telephone number above, including your wireless number if provided, message and data rates may apply. Furthermore, you understand that this consent to receive communications in this way is not required as a condition of purchasing any good or services. If you are Medicare-eligible, a licensed sales agent will contact you about Medicare-eligible, a licensed agent will contact you about Medicare plans by phone or email. Submitting your information to us does NOT affect your current Medicare Part A and Part B enrollment, nor will it enroll you in a Medicare Advantage Plan, Prescription Drug Plan, Medicare Supplement plan or other Medicare plan.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please visit Medicare.gov or

call 1–800-MEDICARE for information on all of your options and eligibility.

We are not affiliated with, connected to, or endorsed by the United States government or the federal Medicare program.

Senior Health Insurance Direct LLC

Terms & Conditions | Privacy Policy

Copyright © 2023 All Rights Reserved